To start trading securely and unlock advanced features, users must complete KYC (Know Your Customer) on Remitano. One of the most important steps is verifying your identity by uploading government-issued documents and completing facial recognition.

In this article, you’ll learn how to verify documents on Remitano, step by step, using either the mobile app or desktop version.

Why Is Document Verification Required?

Why Is Document Verification Required?Verifying your identity helps Remitano:

Protect your account

Prevent fraud and scams

Comply with local regulations

Allow larger trading limits and additional features

Submitting the correct document types and clear images ensures your verification is processed faster.

What Documents Are Accepted?

What Documents Are Accepted?Remitano accepts most government-issued identification, including:

Citizen ID card

Driver’s license

Passport

National identity documents

Voter card (in supported countries)

BVN or NIN (for Nigeria only)

Note: If you have a valid ID not listed, contact Remitano Support for guidance.

Note: If you have a valid ID not listed, contact Remitano Support for guidance.

Step-by-Step: How to Verify Documents on Remitano

Step-by-Step: How to Verify Documents on Remitano

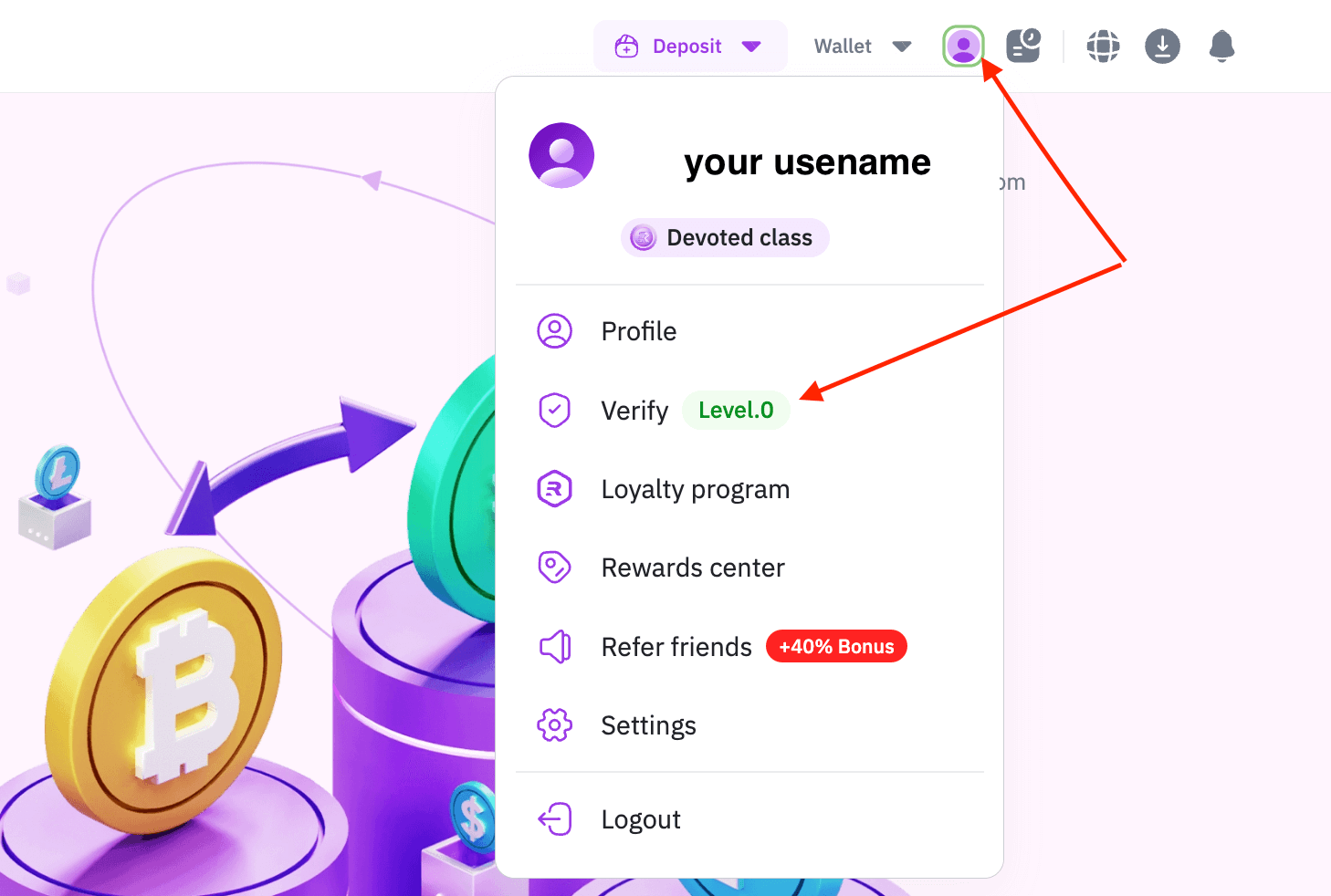

Step 1: Start the Verification Process

Step 1: Start the Verification ProcessLog in to your Remitano account

Click on “Verify” in your profile dashboard

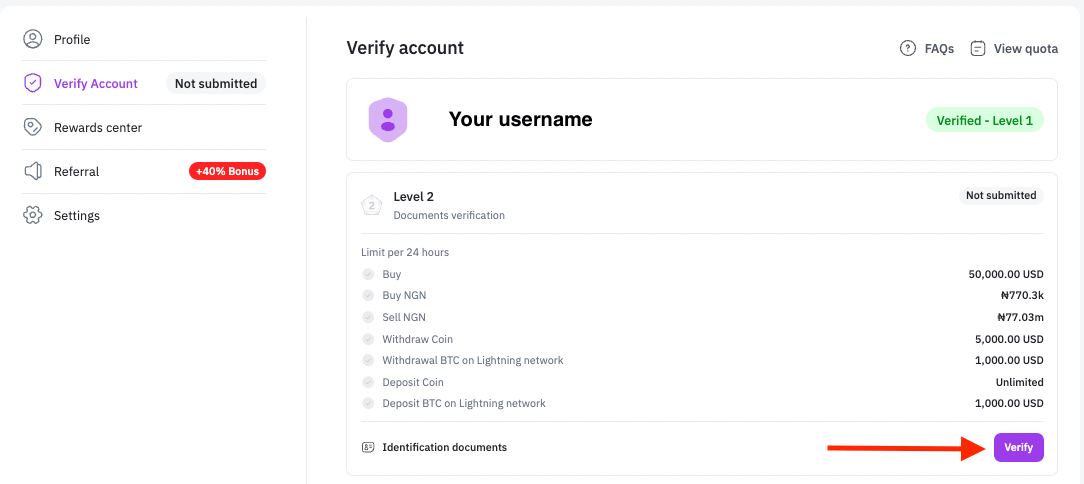

Step 2: Navigate to “Level 2: Document Verification”

Step 2: Navigate to “Level 2: Document Verification”Scroll down to Level 2 – Document Verification

Click “Verify” to begin

You must complete phone number verification before proceeding.

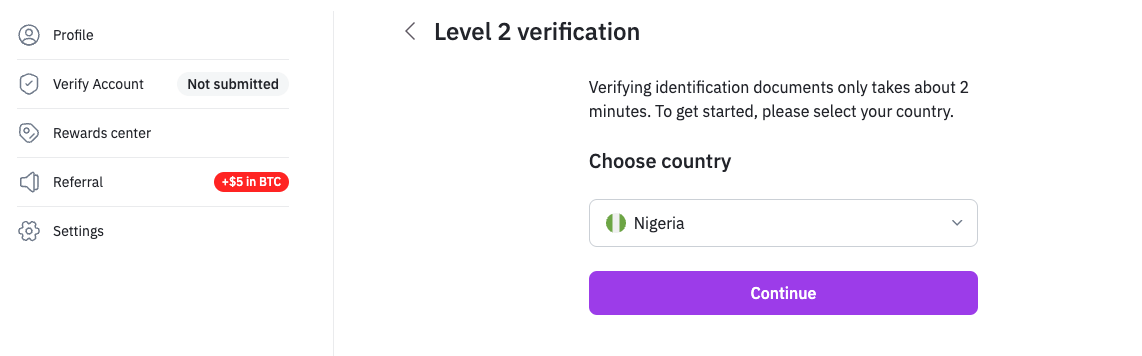

Step 3: Choose Your Country

Step 3: Choose Your CountrySelect your country of residence from the list

Click “Continue”

This helps Remitano display the relevant ID types allowed in your country.

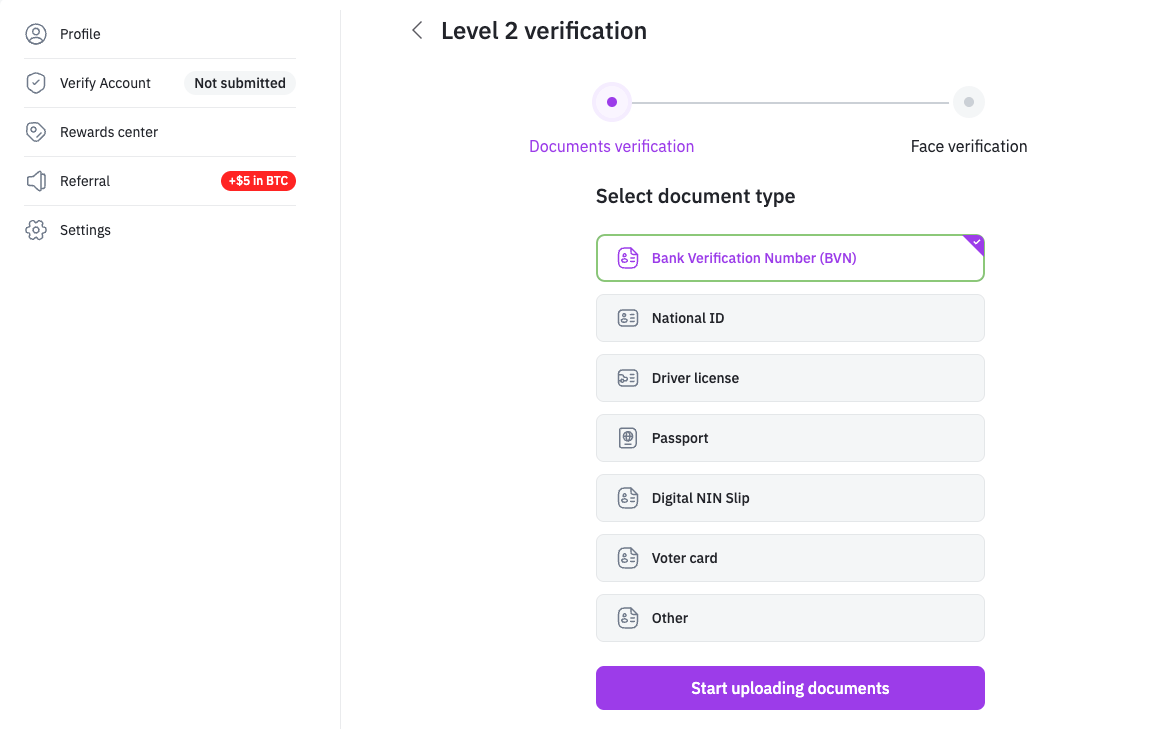

Step 4: Select Document Type

Step 4: Select Document TypeChoose the document you want to upload (e.g., Passport, Driver’s License, National ID), then click:  “Start uploading documents”

“Start uploading documents”

Choose the correct type to ensure automated verification speed.

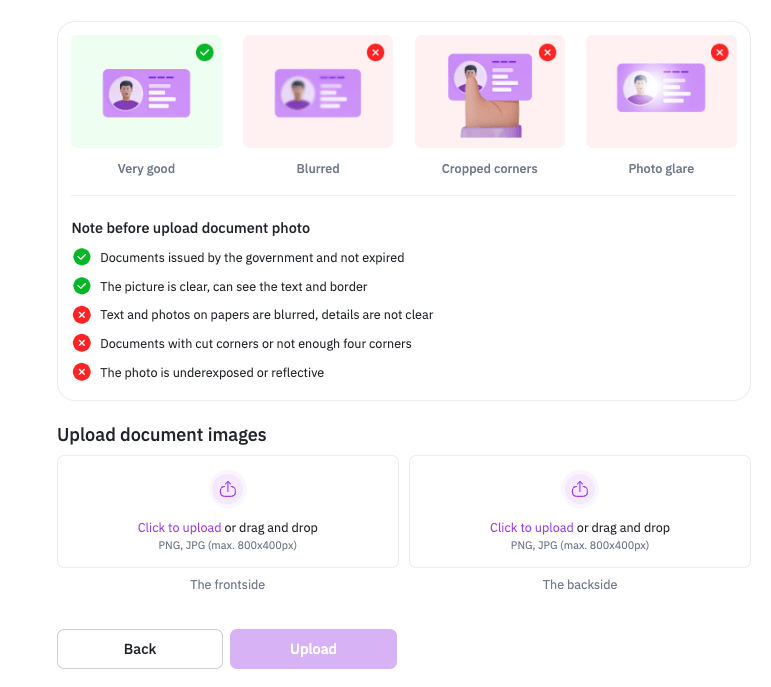

Step 5: Upload Photos of Your ID

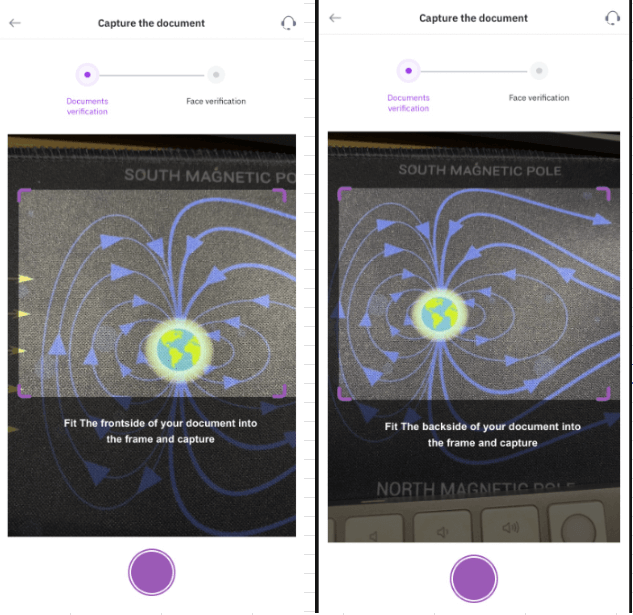

Step 5: Upload Photos of Your IDYou’ll be asked to take or upload clear images of:

Front side of your ID

Back side (if available/applicable)

On Mobile App: Use your camera to take photos directly in the app.

On Mobile App: Use your camera to take photos directly in the app.

On Website: Use your webcam or upload files from your device.

On Website: Use your webcam or upload files from your device.

File size must be under 50MB. If your image is too large, contact Remitano support for help.

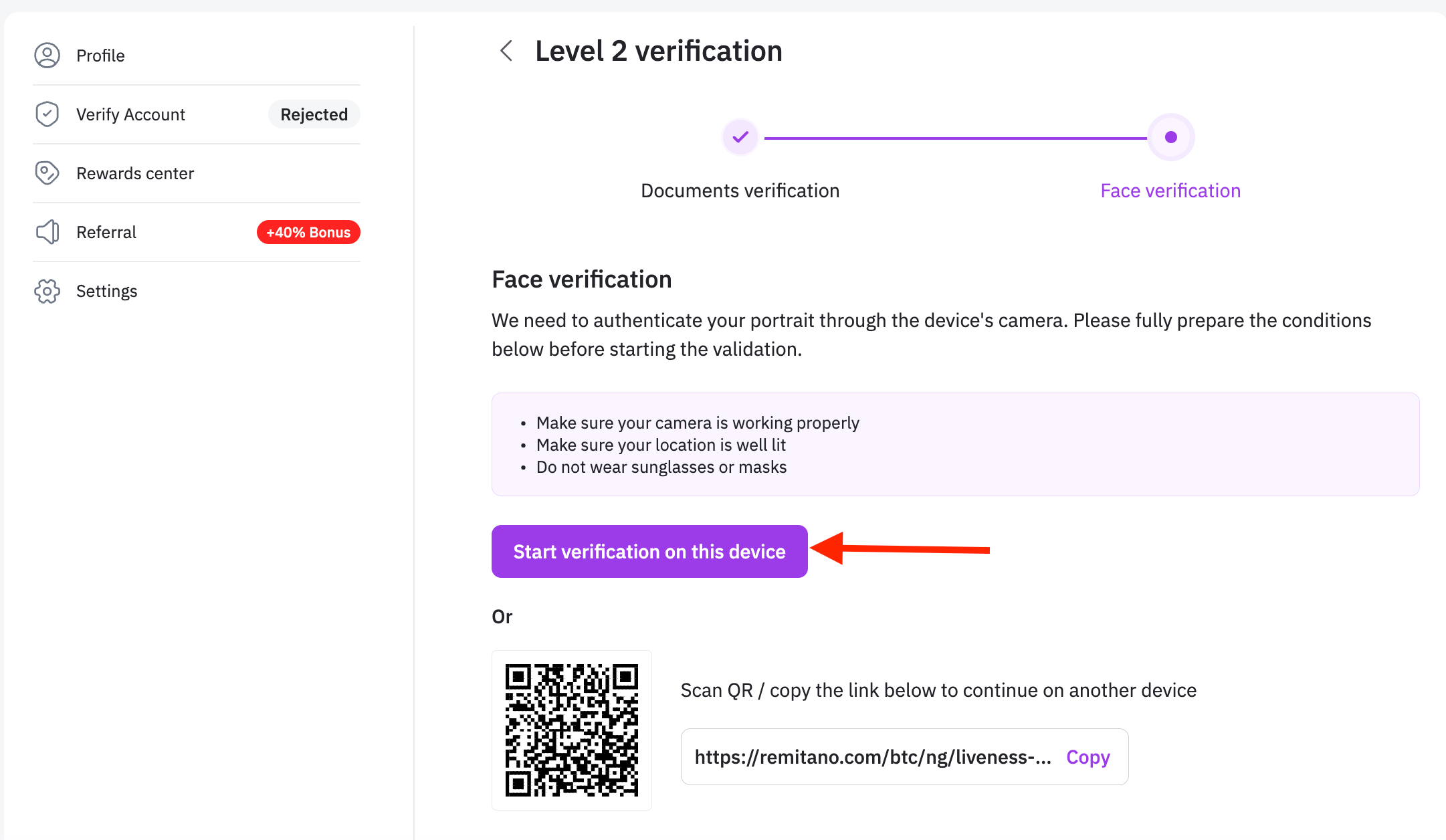

Step 6: Complete Facial Recognition

Step 6: Complete Facial RecognitionAfter submitting your ID:

On Mobile App: Keep your phone still and center your face for 5 seconds

On Web: Click “Start verification” on your device and follow instructions

This step ensures that the ID matches your real identity.

Need help? See the Portrait Validation Guide in the help center.

Need help? See the Portrait Validation Guide in the help center.

How to Set Up Face Verification on Remitano (Level 2 KYC)

What Happens After You Submit?

What Happens After You Submit?Once your images and face verification are submitted:

The system will automatically review your data

You will see “Verified” status at KYC Level 2 if successful

You can then:

Trade without restrictions

Verify your bank account

Increase your withdrawal and transaction limits

Review time is typically within a few hours, depending on queue and region.

Tips to Get Verified Faster

Tips to Get Verified FasterUse a bright and clean background

Hold your ID clearly within the frame

Don’t wear hats, sunglasses, or filters

Make sure your internet connection is stable

Need Help?

Need Help?If you face any issues:

Visit Remitano Support

Chat with support directly in-app

Join Remitano’s [official community channels]

Conclusion: Secure Your Account with Verified Documents

Conclusion: Secure Your Account with Verified DocumentsBy completing KYC Level 2, you unlock more trust and flexibility on Remitano.

Now that you know how to verify documents on Remitano, follow the steps above and get verified today.

Stay safe. Trade with confidence.